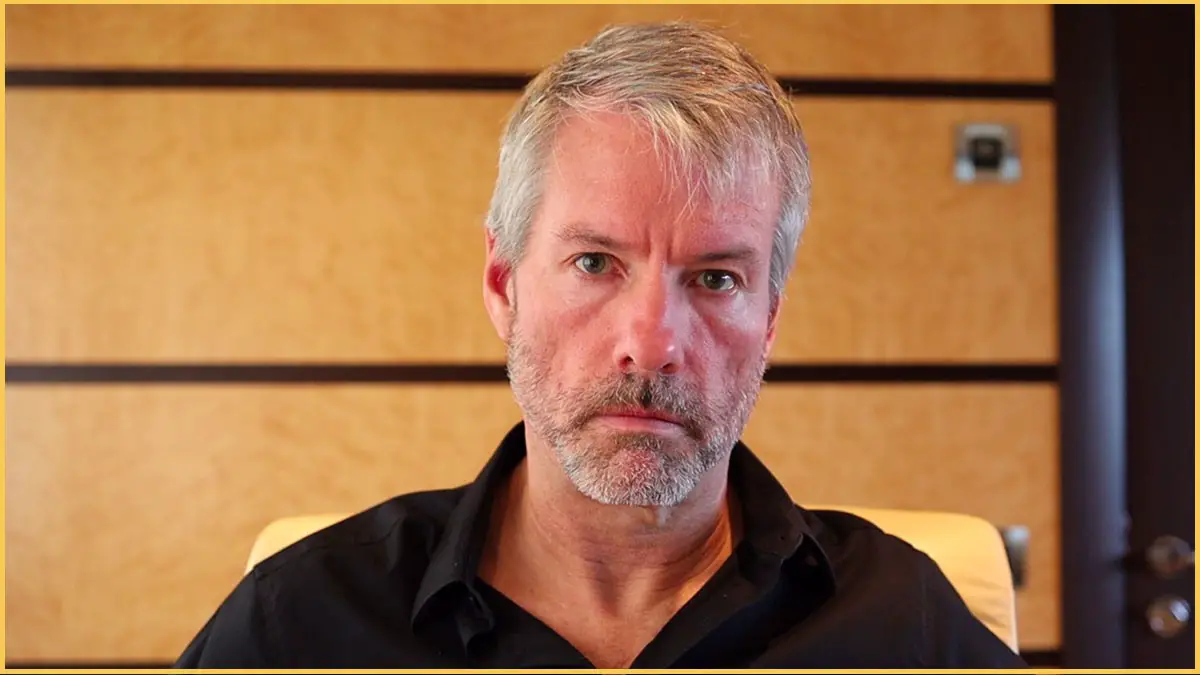

Michael Saylor, the chief executive of MicroStrategy has revealed he accepts other cryptocurrencies in the market aside from Bitcoin. A few weeks ago during an interview, he suggested that Bitcoin was the only investment worth making in Bitcoin but it looks like this was an extreme view that he doesn’t necessarily hold.

In this previous interview, he compared Pepsi with Coca-Cola and suggested that such competition doesn’t exist within the crypto markets. Something that many in the space thought of as a bizarre comment as most crypto traders have a list of their favorite projects that they believe can rival the world’s largest cryptocurrency one day.

The billionaire aired his views on the industry during an episode of CNBC’s Fast Money and stated his opinion on the future of cryptocurrency.

During the interview with Courtney Reagan, CNBC’s senior retail reporter, Saylor was asked for the main reason why the company kept buying Bitcoin. The question was asked as a reference to MicroStrategy’s announcement on June 14 in which the software firm sold $1 billion worth of stock to acquire more Bitcoin.

Saylor responded by describing Bitcoin as virtual gold on a large network and predicted that it will soon be adopted by a vast number of people worldwide. Saylor was dubbed as a Bitcoin Maximalist by Guy Adami, the co-host of Fast Money. Adami asked Saylor for his opinion on Ethereum, and whether the software firm had plans for Ether.

According to Saylor, Bitcoin as a digital asset is the most dominant and the most leading network in the market. Compared to other altcoins, Bitcoin is the building block of the foundation that led to cryptocurrency. As for Ethereum, he stated the crypto was aiming to dematerialize the IP Morgan building and banking establishment of all exchange platforms.

Microstrategy did not have plans to buy Ethereum or other cryptocurrencies in the near future even though Saylor asserted that different cryptocurrencies had a different place in the market.

The software company announced selling $1 billion worth of stock overtime on Monday. On June 9th, Microstrategy announced the completion of its securities offering, stating it had sold $500 million of secured notes, and planned to purchase more Bitcoin.

According to a report by Bitcoin Treasuries, MicroStrategy holds 92.079 Bitcoins which are worth $3.68 billion at current prices.