Over the past few weeks, several prominent cryptocurrencies have significantly plummeted including Dogecoin, Bitcoin, and Ethereum, three of the most major crypto assets in the market. Bitcoin prices steeped from $46,000 to $33,000, while the meme-inspired cryptocurrency Dogecoin steadily dropped from the peak of $0.50 to $0.30. Ethereum also went to as low as $1800 although at the time of writing it is trading at $2700.

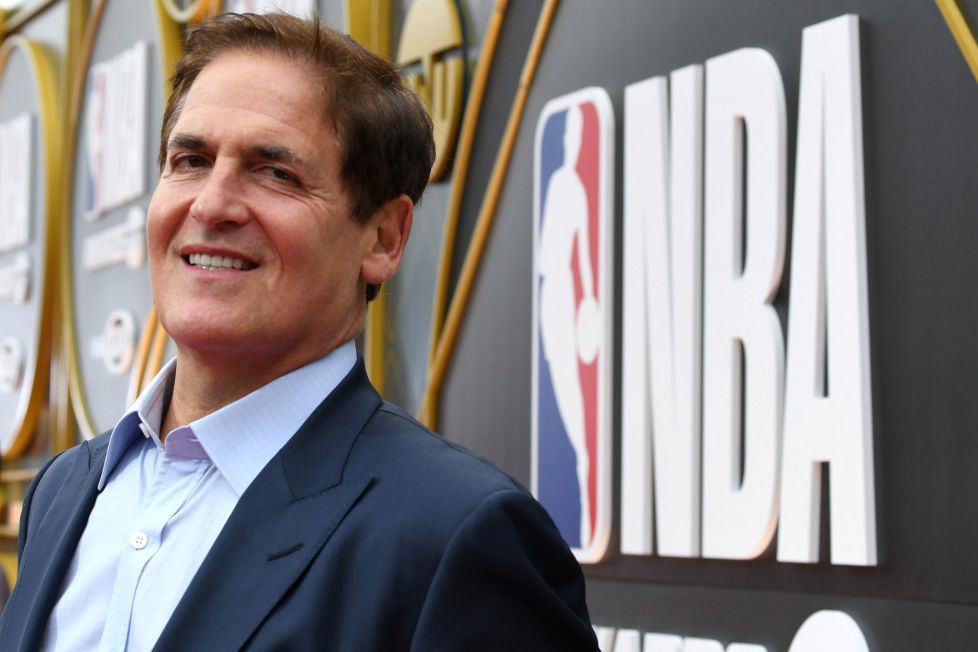

According to the billionaire investor and owner of Dallas Mavericks, Mark Cuban considers the crash as the ‘Great Unwind’. Cuban, who is worth $4.4 billion tweeted that many traders used to borrow Ethereum, and staked the investment for maximum payout, now have to unwind and remove liquidity, and repay the moment Ethereum drops in prices.

Cuban’s statement came as a response to a post made by the director of research at The Block, Larry Cermak. The researcher pointed out his opinion in regards to the 1:1 forks of Ethereum, stating the accentuation of buyers and money can lead to serious implications.

Cermak followed up on his statement, stating the main cause of the crypto crash was the abundance of projects, all of which were stretched to absurd valuations that did not have enough liquidity to support the price rates as the demand dried up.

Cuban added to his initial comment with a follow-up stating major cryptocurrencies with dry powder, highly liquid marketable securities used to support holdings, will unwind when they are struck with Double Tragic Numbers.

In an email to Newsweek, Cuban stated a platform’s success depends on its utilities. A platform with plenty of utilities will always be more successful.

The crypto market remains volatile as many of the prominent cryptocurrencies including Bitcoin, Ethereum, and Dogecoin that once soared in prices now have declined in prices on a daily basis.