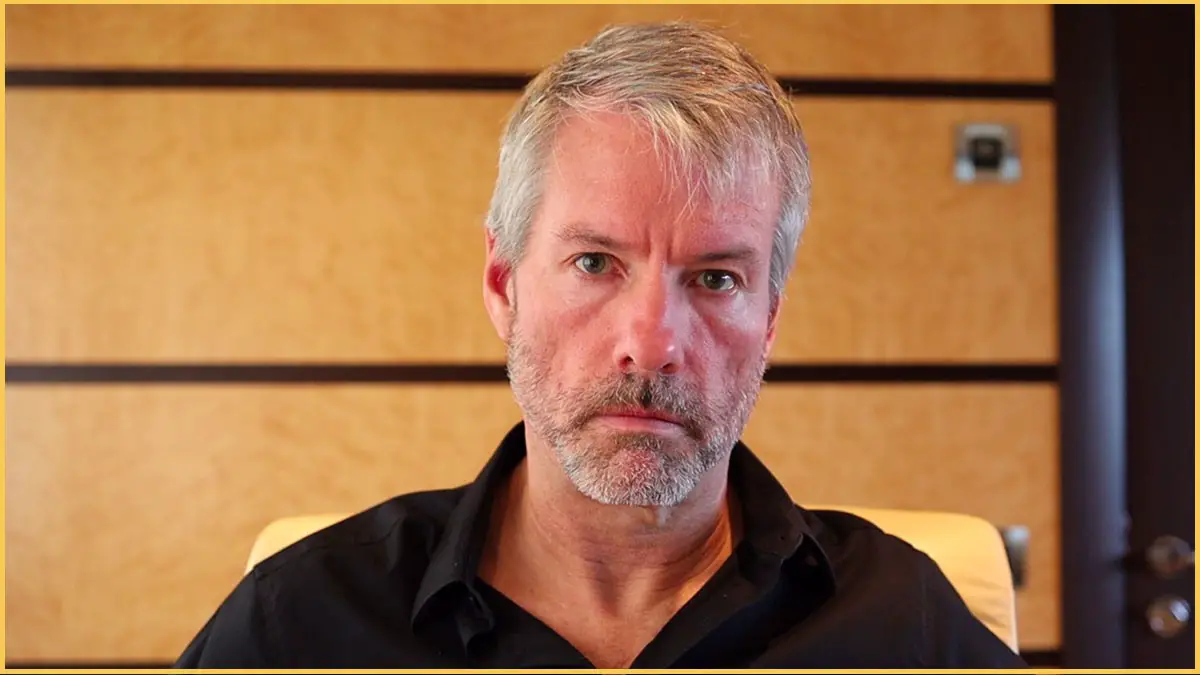

Conventional financial markets were initially unable to accept bonds backed by Bitcoin in the early stages of their development. MicroStrategy CEO Michael Saylor claims that traditional financial markets aren’t ready for bonds backed by Bitcoin. Borrowers aren’t prepared for Bitcoin-backed bonds, like mortgage-backed securities, says Saylor. A term loan from the central bank was needed at this point.

Two days earlier, MicroStrategy’s bitcoin-focused subsidiary Macro Strategy disclosed that it had taken out a $205 million BTC-collateralized loan to acquire further Bitcoin. MicroStrategy is the only corporation to borrow against its Bitcoin holdings. This would be done with the aim of acquiring more of the cryptocurrency. According to Saylor, the volcano Bond issue in El Salvador has been postponed until further notice.

He added that Finance Minister Alejandro Zelaya of El Salvador postponed the bond offering considering Ukraine. A caution to the government could come from Saylor’s claim that El Salvador’s Volcano Bond is a bit riskier than his company’s Bitcoin-collateralized loan.

“That’s a hybrid sovereign debt instrument as opposed to a pure Bitcoin-treasury play. That has its own credit risk and has nothing to do with the Bitcoin risk itself entirely.”

According to Saylor, Bitcoin-based bonds have the potential for long-term success. He believes that issuing debt in Bitcoin would be a wise move for cities such as New York.

“New York can issue $2 billion of debt and buy $2 billion worth of Bitcoin — the Bitcoin is yielding 50% or more, the debt costs 2% or less.”

MicroStrategy’s Investment In Bitcoin Is Insane!

As of August 2020, MicroStrategy’s initial $250 million BTC investment was worth $5.5 billion. MicroStrategy has undertaken purchases of Bitcoin using cash on hand and proceeds from the issuing of senior convertible notes to institutional investors. Saylor’s initiatives have transformed MicroStrategy into a partly leveraged Bitcoin holdings company, with shares directly linked to the price of Bitcoin.